What to Budget for Living Expenses in Canada as a Master’s Student

Planning your monthly expenses in Canada for students is a crucial step for a smooth study experience. Living costs in Canada can be quite different from those in Nigeria, Ghana, Pakistan, or other home countries, so it’s important to create a realistic budget.

This guide focuses on the cost of living in Canada for international students pursuing a master’s, covering typical living expenses and providing a sample budget.

Average Cost of Living in Canada for International Students

Canada’s living expenses vary by city and lifestyle, but many sources suggest budgeting around CAD $15,000–$20,000 per year for living costs and rent. That works out to roughly CAD $1,200–$1,700 per month. In fact, the Canadian government requires proof of funds of about $10,000 per year for living expenses when issuing a study permit, which is a bare minimum. Keep in mind that costs in major cities like Toronto or Vancouver can be higher, while smaller towns may be more affordable.

Housing

Housing is typically the largest expense in a student’s budget. Rent in Canada depends on the type of accommodation and location. Many master’s students opt for shared housing to save money. A room in a shared off-campus apartment or house can cost about CAD $400–$700 per month. On-campus residence might range from CAD $3,000–$7,000 per academic year, roughly $500–$900 per month. Don’t forget to factor in utilities like heat, electricity, water, which may be included in rent or add around $50–$100 monthly if separate.

Food & Groceries

Food expenses will depend on your lifestyle. Cooking your own meals most of the time is the budget-friendly approach. On average, expect to spend around CAD $200–$300 per month on groceries if you cook at home. If you opt for an on-campus meal plan, costs might be fixed per semester, for example, around $800–$1,200 annually for meal programs, depending on the university. Eating out regularly will increase your costs – a simple restaurant meal in Canada can be $12–$20, and more for fancier places.

Transportation

Transportation costs in Canada largely depend on the city and how far you live from campus. Fortunately, as a student you often get discounts on public transit. A monthly public transit pass typically costs about CAD $80–$120 with student pricing. For example, cities like Ottawa or Winnipeg might be on the lower end, while Toronto or Vancouver are on the higher end of around $100+ for a monthly pass. If you live on campus or close by, you might save by walking or biking. Some universities include a transit pass in student fees, effectively making it “pre-paid.”

Health Insurance

Health insurance is mandatory for international students in Canada. Medical care is expensive without insurance, so you’ll need to either enroll in a provincial health plan or buy private coverage. The cost varies by province, but on average health insurance for international students ranges from CAD $600 to $900 per year, which is roughly $50–$75 per month. Some provinces (like British Columbia) charge a fixed monthly fee of around $75 for health coverage, while others require you to join a university-provided plan like UHIP in Ontario or guard.me insurance, sometimes included in your tuition or student fees.

Phone & Internet

Canada’s cell phone plans are known to be pricey. A plan with a few GB of data and unlimited texts/calls costs about CAD $40–$60 per month on average, although some providers offer special student deals or lower prices for limited plans. You can save by choosing a smaller carrier or a prepaid SIM card, and by avoiding plans with more data than you need. For home internet, if you live off-campus, expect roughly CAD $50–$80 per month for a broadband connection which can be split with roommates.

Personal & Miscellaneous Expenses

This category can vary widely between students, but setting aside around CAD $100–$200 per month is a good starting point. This budget would cover basics like toothpaste, shampoo, and laundry, plus some nights out, movie streaming subscriptions, or hobby expenses. If you need winter clothing, a must for Canada’s climate, your costs might spike in the first year – a good winter coat and boots are an investment but will last. Also consider expenses like haircuts, occasional electronics or books, and emergency funds for unexpected costs (for example, a laptop repair).

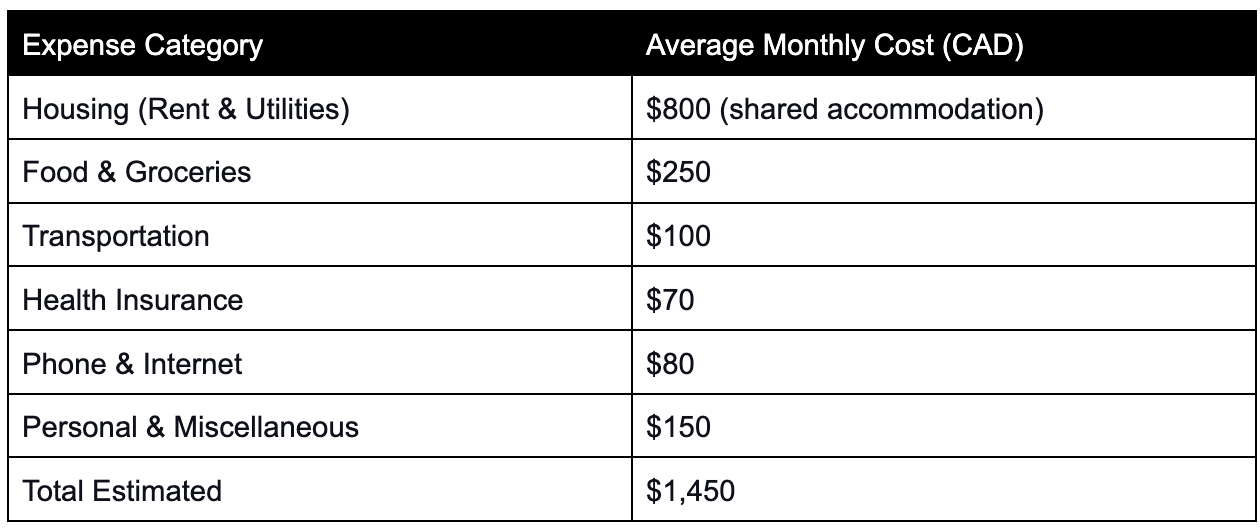

Sample Monthly Budget for a Master’s Student in Canada

Below is a sample monthly budget (in CAD) for a master’s student’s living expenses. This gives a ballpark of what you might expect to spend each month, though individual circumstances will vary:

Conclusion: Managing Your Student Budget and Money Transfers

Transferring funds from your home country is key. You’ll likely be using savings or family support from back home (in Nigerian Naira, Ghanaian Cedis, Kenyan Shillings, Pakistani Rupees, etc.) to pay for some of these expenses. Rather than carrying large amounts of cash, use secure and cost-effective transfer methods. For example, Vavita is a service that helps students from emerging markets manage and transfer funds for education and living expenses abroad to avoid high bank fees and delays.